Services

Tax and Estate Planning Techniques and Services

Dispute Resolution

Estate and/or Gift Tax Return Preparation or Consulting

Family Foundations

Trust Administration, Reformation, Termination and Modification

Probate

Post-Mortem Tax Planning

Educational Trusts

Planning with Qualified Plan Assets

Buy/Sell Agreements

Wills, Powers of Attorney and Living / Revocable Trusts

Family Business Succession Planning

Charitable Remainder or Lead Trusts

Family Limited Partnerships or Family Limited Liability Companies

Irrevocable Life Insurance Trusts

Qualified Personal Residence Trusts

Installment Sales to Defective Grantor Trusts

Opportunity Transfers

About

Honey Law Group

Bio

Jennifer M. Honey

Professional Experience & Affiliations

Prior to beginning her own law practice, Ms. Honey was an associate for the law firm of Reish & Luftman as well as a consultant for the Family Wealth Planning Group of the Los Angeles office of Arthur Andersen. Ms. Honey is recognized by the California State Bar as a certified specialist in the field of Estate Planning, Trust and Probate. Ms. Honey has served as a tax and estate planning advisor for several of Los Angeles’ largest private foundations as well as high net worth individuals, families, estates, and family businesses, including the Getty and Keck estates. Ms. Honey’s experience includes estate, tax and charitable planning; creation of private foundations; trust planning; family business succession planning; creating and advising family limited partnerships and limited liability companies; post-mortem planning; planning with qualified plan assets; life insurance tax planning; and administration of probates, trusts and estates.

Ms. Honey is admitted to practice before the United States Tax Court and is a member of the Estate and Gift Taxation and Estate Planning, Trust and Probate Law Sections of the State Bar of California. Ms. Honey is also a member of the Estate Counselors Forum, South Bay Bar Association and the South Bay Legal Consortium. Ms. Honey is an adjunct professor for Loyola Law School’s LLM program, as well as for the University of California at Los Angeles, teaching estate planning.

Education

Ms. Honey is a graduate of the University of Southern California and received her Juris Doctorate from University of the Pacific, McGeorge School of Law. Ms. Honey received a Masters of Law degree in Estate Planning and Estate and Gift Taxation from the University of Miami Law School in 1996, where she served as chairperson for the Volunteer Income Tax Assistance Program.

Publications and Presentations

Ms. Honey has published numerous estate planning articles, including “A Look at the Qualified Personal Residence Trust in 1999″” published by the Journal of Accountancy. Ms. Honey has taught estate planning at Santa Monica College. Ms. Honey is a frequent public speaker and has given numerous presentations to various professional organizations, including the American Institute of Certified Public Accountants, Salomon Smith Barney, Morgan Stanley, Charles Schwab, Arthur Andersen and Miami Law School.

Tax and Estate Planning Techniques and Services

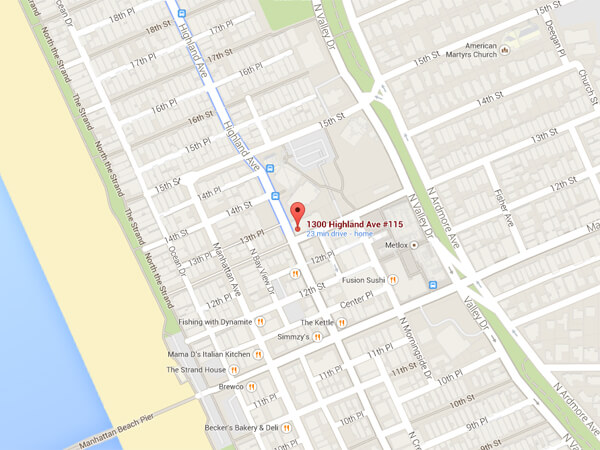

Address: 1300 Highland Ave, Ste. 115, Manhattan Beach, CA 90266

Phone: (310) 545-7579

Honey and Copp is located at 1300 Highland Ave, Ste. 115 immediately across the street from Uncle Bill’s Pancake House. Our offices are on the interior of the building’s ground floor and can be accessed from the entrance along 13th Street. In locating 1300 Highland, you will see a Stand Up Paddleboard shop on Highland Avenue.

All parking in Downtown Manhattan Beach is metered; most meters accept credit cards, though some still only accept coins. Limited street parking is available along 13th Street as well as Highland Avenue, immediately adjacent to our building. More ample parking is available in the Metlox Parking Structure, which may be accessed from Morningside Drive (a one-way street entered from Manhattan Beach Boulevard or 12th Street), or the City Hall Parking Structure located on 13th Street.